Pennington Markets Monthly

(March, 2025)

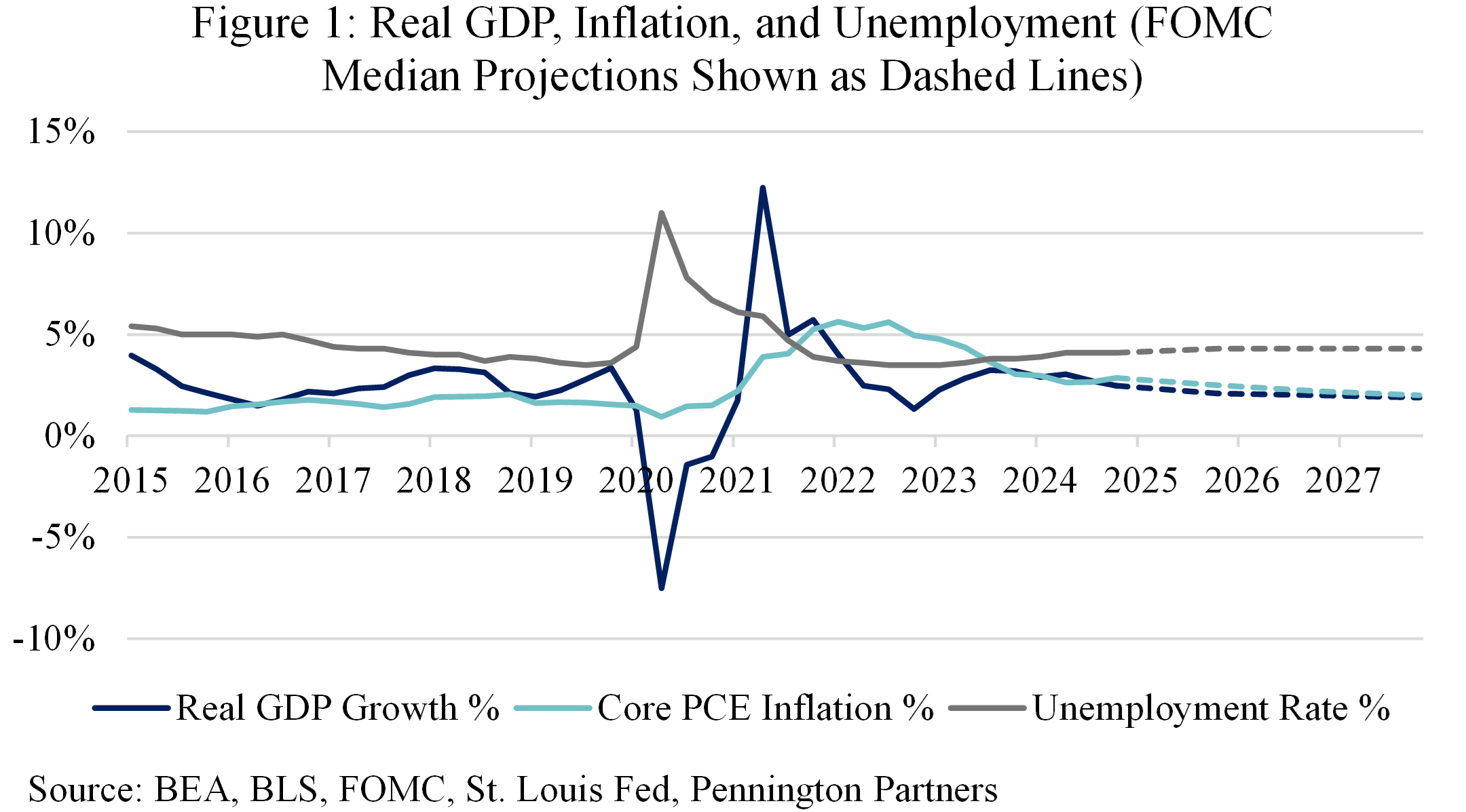

STUBBORN INFLATION, SLOW GROWTH ARE THE BIGGEST RISKS FOR 2025

Risks for a low growth, rising unemployment and stubborn inflation environment in 2025 are rising, as is the risk of an outright recession (Figure 1)

Longer term, tax cuts are expected to worsen the federal budget deficit, potentially increasing long-term rates and contributing to bond market uncertainties

Low but persistent inflation and stagnant growth not priced into markets

Persistent higher-than-Fed-desired inflation should shift portfolios to opportunities in real assets, constrained industries with pricing power, cost-saving M&A, and high but flexible income